SAM Magazine—Winter Park, Colo., Jan. 18, 2024—The challenges presented by meager snowfall, school holidays that started nearly a week later than usual, and ongoing resistance to high daily rates at Western mountain destinations dampened occupancy during December, according to the monthly Market Briefing released by DestiMetrics, the business intelligence division of Inntopia.  December marked the second consecutive month that aggregated revenues declined for DestiMetrics' 17 participating destinations in Colorado, Utah, California, Nevada, Wyoming, Montana, and Idaho.

December marked the second consecutive month that aggregated revenues declined for DestiMetrics' 17 participating destinations in Colorado, Utah, California, Nevada, Wyoming, Montana, and Idaho.

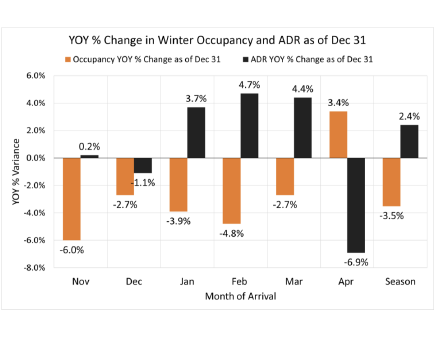

Compared to December 2022, occupancy dipped 2.7 percent and the average daily rate (ADR) slipped 1.1 percent. As a result, revenues were 3.8 percent lower.

Addressing the rate issue, Tom Foley, senior vice president of business intelligence for Inntopia, said, “Declines in the holiday period, when rates are 5-20 percent higher than any other time of the year, can have a substantial impact on revenues for the month—and the season.”

As of Dec. 31, bookings for the full winter season, November through April, are down 3.5 percent compared to last year at this time. ADR for the winter as a whole is up a modest 2.4 percent. Notably, February rates are up 4.7 percent over last year, and March is coming in with its single highest aggregated average daily rate ever—more than $726/night. Even with all that, winter revenues are currently down 1.2 percent vs. last year.

The briefing noted that the dry conditions that dominated the weather patterns across much of the Western U.S. during December provided little incentive for potential visitors to make last-minute travel plans, and that dampened short-lead bookings. The occupancy decline was greatest in the last two weeks of the month, when rates are typically at their highest.

The later-than-usual school break, which extended through the first week of January, was expected to pick up some of the December decline. But as of Dec. 31, that projection had changed; occupancy for the month of January was barely even, and in some cases down, compared to the prior year. Overall, total occupancy for the week of Dec. 16-21 finished down 8.1 percent, while the first week of January was up only a slight 1 percent.

Once again, trends for the winter are highlighting the consumer's growing sensitivity to price pressures. “The impact of high daily rates on bookings and occupancy has been apparent since last February,” noted Foley (see chart).

“We have seen a clear correlation between gains in rate leading to lower occupancy and vice-versa,” he continued. “It is particularly notable right now in January through March, which are showing marked increases in ADR but declines in occupancy. In contrast, April rates are down sharply and there has been a significant increase in bookings as consumers respond to that lower price incentive.”

The briefing noted that across all price ranges, lodging properties' revenues are either flat or down slightly. Notably, economy properties (those with ADR of $400 or less) slipped the most, as their asking rates softened back in November but their occupancy still dropped 6.9 percent.

On a positive note, Foley observed that the season is still relatively young, and the situation could improve quickly. "The economic indicators are more upbeat than they have been for months, inflation is receding, and best of all, the magic wand of Mother Nature has delivered abundant snowfall at many Western mountain resorts in the past week. That combination can easily change this season’s narrative in a very short time,” he said.