SAM Magazine—Winter Park, Colo. April 18, 2025—Uneven snow conditions and tumultuous economic policies in March and April converged to make the final weeks of the 2024-25 ski season less robust than hoped. But according to Inntopia’s most recent DestiMetrics monthly Market Briefing report, two of three core performance metrics for the season—average daily rates (ADR) and revenues—remained solid for the six months from November through April, while occupancy slipped.

DestiMetrics, part of the Business Intelligence platform for Inntopia, tracks lodging performance in 17 mountain destination communities across Colorado, Utah, California, Nevada, Wyoming, Montana, and Idaho.

In a year-over-year comparison, actual occupancy for March dipped 0.6 percent, while ADR slid 0.7 percent. The combination delivered a 1.3 percent decrease in revenue for the month. For the full winter season, occupancy declined 0.5 percent as ADR rose 1.9 percent, resulting in a 1.4 percent increase in seasonal revenues.

The report holds both good and bad news for April and beyond.

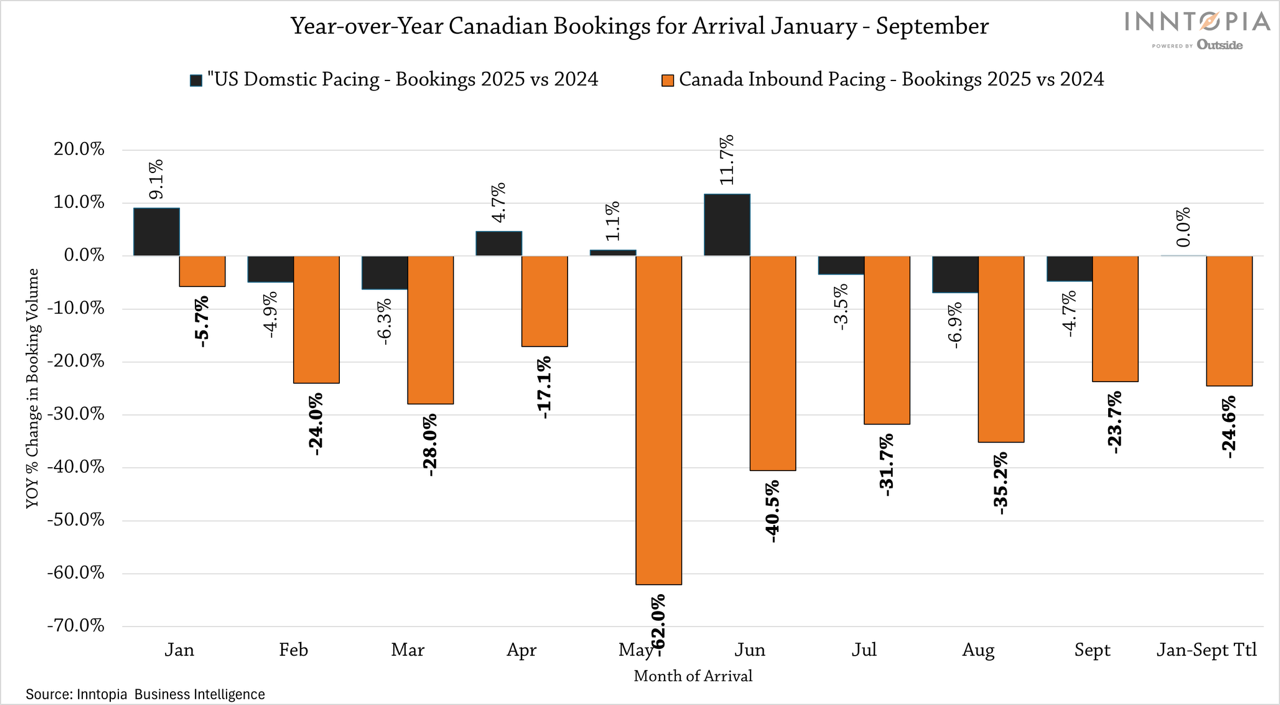

Hopes for a late season surge in Easter bookings didn’t materialize. Canadians have pulled back sharply on booking U.S. destinations, with many cancelling existing reservations. In contrast, summer bookings, with generally lower rates in mountain destinations, are showing more spark—although economic and geopolitical forces are also having an impact.

“Consumers went into March with already declining confidence, and the very late Easter holiday appears to be too late to drive significant destination visits to the mountains. When coupled with a fairly strong pullback from international travelers, especially Canadians, that combination is pulling down occupancy and softening modest revenue gains,” noted Tom Foley, senior vice president of business intelligence for Inntopia.

Canadian bookings continue to drop significantly, as tariff threats and political rhetoric dissuade travel from Canada. As of March 31, Canadian-sourced bookings from January through September were down 22.7 percent compared to the same time last year. This compares to a mere 0.2 percent drop for domestically-sourced reservations.

“Dependence on Canadian travelers varies by destination,” said Foley. “However, the trend may be indicative of other international inbound markets, so we’re monitoring both Europe and Mexico for similar patterns, as these visitors travel to many U.S. regions and resorts,” he continued.

Nonetheless, bookings for May through August all increased, though they still lag year-ago levels. Foley observed that “the summer months are currently looking better from a rate and revenue perspective." That's because "summer rates in mountain destinations are more enticing and can attract a wider range of visitors,” he explained.

"Although the summer numbers on occupancy are down slightly, this is early in the booking season," Foley cautioned. "We will get a much better picture of how consumers are feeling about their warm weather travel plans amidst all this economic turmoil in the next 4-6 weeks.”