One year ago, the marquee lift story was Vail Resorts’ Epic Lift Upgrade, a scramble to build 18 new lifts across 12 mountains in one summer, part of a banner construction year across the industry. This year the pendulum swung as Alterra Mountain Company and Boyne Resorts became the largest customers for new lifts, and several independent operators installed a variety of new ropeways, from fancy eight-passenger chairs to utilitarian fixed-grip triples.

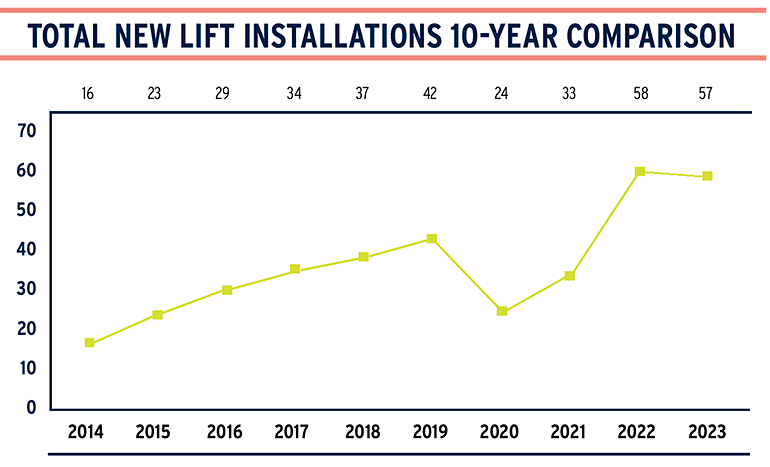

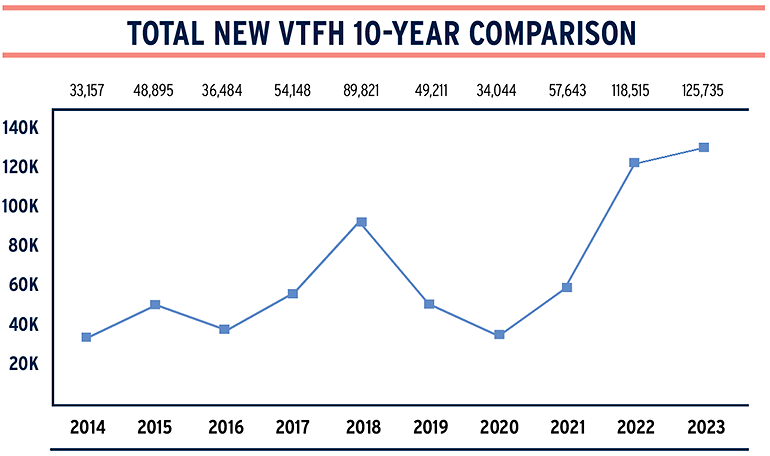

While the overall number of projects stayed about the same as 2022—57 new ropeway installations at North American ski areas this year compared to 58 last year—average project size increased in 2023 as operators boosted capacity and installed some big lifts with a total of 125,735 vertical transport feet per hour (VTFH), up about 7,200 from 2022.

Note: VTFH measures the number of riders who can be transported 1,000 vertical feet in one hour. It is derived by multiplying the vertical rise in feet by the lift capacity per hour and dividing by 1,000.

Note: VTFH measures the number of riders who can be transported 1,000 vertical feet in one hour. It is derived by multiplying the vertical rise in feet by the lift capacity per hour and dividing by 1,000.

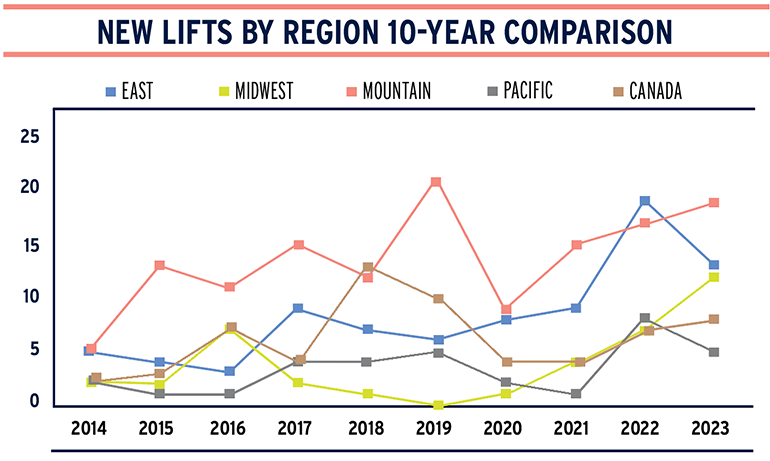

These line charts provide a more visual illustration of the 10-year comparisons that are typically presented as tables here in the annual Lift Construction Survey (which are in the online version at saminfo.com), making it easier to see trends. For example, “New Lifts by Region” shows the consistent growth of new installations in the Midwest, from zero in 2019 to 12 in 2023, outpacing all of Canada and nearly equalling the East’s 13 new lifts. The correlation between total new lifts and total VTFH is also interesting to see. More installations doesn’t always equate to more VTFH, and vice versa.

These line charts provide a more visual illustration of the 10-year comparisons that are typically presented as tables here in the annual Lift Construction Survey (which are in the online version at saminfo.com), making it easier to see trends. For example, “New Lifts by Region” shows the consistent growth of new installations in the Midwest, from zero in 2019 to 12 in 2023, outpacing all of Canada and nearly equalling the East’s 13 new lifts. The correlation between total new lifts and total VTFH is also interesting to see. More installations doesn’t always equate to more VTFH, and vice versa.

Multi-Mountain Operators

Alterra-owned Steamboat Resort, Colo., completed the largest lift ever in North America, the 3.16-mile-long Wild Blue Gondola. While the first section of the Doppelmayr D-Line gondola opened last winter, the 2.3-mile upper section built this year has North America’s largest VTFH by itself, rising 2,782 vertical feet and carrying 3,200 passengers per hour in 10-person cabins. It required the largest-diameter haul rope ever used on a U.S. lift—64 mm—and the largest direct drive motor Doppelmayr has ever installed worldwide.

“Besides the sheer size, it’s the only lift of its size that is a true bottom station drive,” says Katharina Schmitz, president of Doppelmayr USA. “An important factor in terms of making the project happen was not having to run a new power line to the top of the mountain.”

Steamboat simultaneously partnered with Leitner-Poma of America to build a 6,300-foot-long detachable quad serving 650 acres of new terrain on Mahogany Ridge. With four new lifts opened in two years, the lift portion of Steamboat’s “Full Steam Ahead” capital improvement initiative is complete.

Leitner-Poma’s largest new lift of the year sits at another Alterra resort not far from Steamboat. The six-passenger Wild Spur Express replaced one of Winter Park’s (Colo.) original detachable lifts and is designed to carry 2,800 passengers per hour along a 6,600-foot span. New this year, the lift adds an intermediate station, allowing guests riding certain trails to board midway instead of negotiating a long, flat runout. Leitner-Poma senior sales manager Jon Mauch says the mid-station features a “bubble” where chairs jog out and back into the lift alignment for easier loading.

Alterra again contracted with Doppelmayr for a six-place detachable at Mammoth Mountain’s Canyon Lodge base. The new lift features automatic in-station carrier parking, an option multiple customers chose this year for detachable lifts. Mammoth wanted the option to park carriers during storms but not the capital and labor expense of a dedicated building with manual parking. Instead, concrete and glass walls surround each station to protect parked carriers from the elements.

With additional projects at Snowshoe, W.Va.; Schweitzer, Idaho; Stratton, Vt.; and Solitude, Utah, Alterra’s total 2023 lift investment included 10 projects, ranging from a 70-foot conveyor at Stratton all the way up to the 2.3-mile gondola at Steamboat.

Michigan-based Boyne Resorts also invested heavily, with a new aerial tram, nine chairlift projects, and seven new conveyors spread across nearly all its resorts. The flagship is the new Lone Peak Tram at Big Sky, Mont., constructed by Garaventa over the past two summers. A global team of workers utilized helicopters and two tower cranes to complete the project on time despite challenging terrain and weather. The new tram starts lower on the mountain than a previous 15-person tram and can carry up to 75 passengers at a time. It was the first tram Doppelmayr/Garaventa had installed since Jackson Hole Mountain Resort’s (Wyo.) in 2008.

Elsewhere in Boyne’s portfolio, Brighton, Utah; The Highlands, Mich.; and Sunday River, Maine, all debuted new six-place D-Line lifts, the latter two with bubbles, heated seats, and auto closing restraint bars. They are the first six packs with auto closing and locking bars in North America. “[Boyne Resorts president] Stephen Kircher is really moving the entire U.S. ski industry, not only his mountains, to move to new lift technology,” says Schmitz, noting that more projects with Boyne are in the works.

Progress on the terminal for Brighton’s (Utah) new Doppelmayr D-Line six-pack.

Progress on the terminal for Brighton’s (Utah) new Doppelmayr D-Line six-pack.

Vail Resorts. Two of Vail Resorts’ five 2023 lift projects were holdovers from last year’s Epic Lift Upgrade not able to be completed due to environmental and permitting challenges. The company finished the Bergman Bowl expansion at Keystone, Colo., in November, adding 550 acres of high alpine terrain served by a Leitner-Poma six-place detachable. The company also installed its first-ever eight seat detachable at Whistler Blackcomb in British Columbia, replacing an aging high-speed quad. Increasing on-mountain capacity drove both upgrades, with the two machines capable of transporting 3,000 and 3,300 skiers per hour, respectively.

Mid-sized ownership companies with between two and five mountains also ordered numerous lifts in 2023. The Holding family invested in a large Leitner-Poma six pack at Snowbasin, Utah, and two Doppelmayr detachable lifts at Sun Valley, Idaho—part of a total lift rebuild on the Warm Springs side of Bald Mountain. » Sun Valley’s new base-to-summit six-seater is the second largest lift ever built in the United States by VTFH (8,159) after Steamboat’s new gondola. Like Wild Blue, it also features a direct drive.

Terminal parts arriving for the big Leitner-Poma six-pack at Snowbasin, Utah.

Terminal parts arriving for the big Leitner-Poma six-pack at Snowbasin, Utah.

Aspen Skiing Company completed the long-awaited Hero’s expansion on Aspen Mountain, adding 153 acres of intermediate and advanced skiing served by a Leitner-Poma detachable quad. Midwest Family Ski Resorts debuted big six-seat lifts at two of its three properties: Snowriver, Mich., and Lutsen Mountains, Minn. The New York State-owned Olympic Regional Development Authority added new or replacement lifts at all three of its mountains.

All told, about 70 percent of new aerial lifts were purchased by companies operating more than one resort.

Independents Upgraded, Too

Still, some independents managed big projects. Mount St. Louis Moonstone in Ontario installed an eight-place Doppelmayr detachable designed to carry a whopping 4,250 passengers per hour (initial capacity is 3,750 pph), the highest throughput of any lift in North America. The CA$14 million (about $10.3 million) machine is the first eight-seater in Canada (along with Whistler’s), and it replaced a six-pack, making MSLM the first North American ski area ever to replace a six pack with a larger lift. It has heated seats, a loading conveyor, in-terminal LED screen, and a unique L-shaped loading station to support the lift’s high capacity and give guests more room between chairs at loading.

Mt. Hood Meadows, Ore., also boosted out-of-base capacity, replacing a detachable quad with a 3,600 pph six-pack from Leitner-Poma.

Replacements. In the Midwest, Northeast, and Canada, independent mountains undertook numerous projects, replacing aging equipment with new quads, including a detachable at Massanutten, Va., and fixed-grips at Middlebury Snowbowl, Vt., and Beaver Valley, Ontario. Bottineau Winter Park, N.D., even retired a Hall T-bar for a new T-bar, the smallest new lift of the year.

“There are more customers out there than just Vails and Alterras,” says Mauch at Leitner-Poma. “There are a lot of people out there buying one-off lifts and business has never been better.”

Schmitz shares similar sentiments. “There are a lot of individually owned ski resorts making wonderful improvements, small or big,” she notes. “If you want to be successful as a ski area, you need to invest in the guest experience, and that is what we are seeing.”

As the price of lifts continues to rise with inflation, some ski areas opted to reinstall used lifts as an alternative to costly new machines. Red Lodge Mountain, Mont., refurbished and reinstalled a CTEC detachable triple retired from Alta, Utah; China Peak, Calif., saved millions by repurposing a fixed grip quad from Jackson Hole Mountain Resort.

Attitash, N.H., replaced an old triple with a new Leitner-Poma detachable quad.

Attitash, N.H., replaced an old triple with a new Leitner-Poma detachable quad.

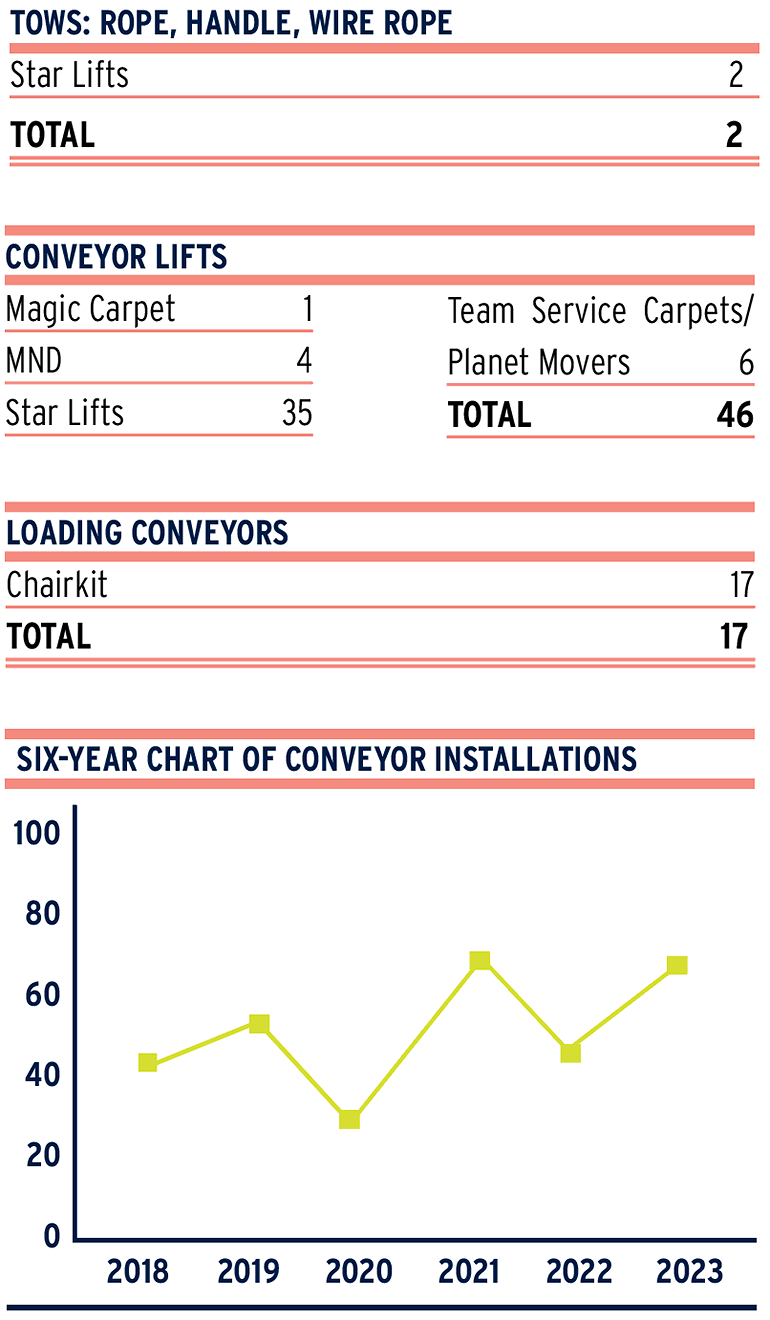

Conveyors Also Booming

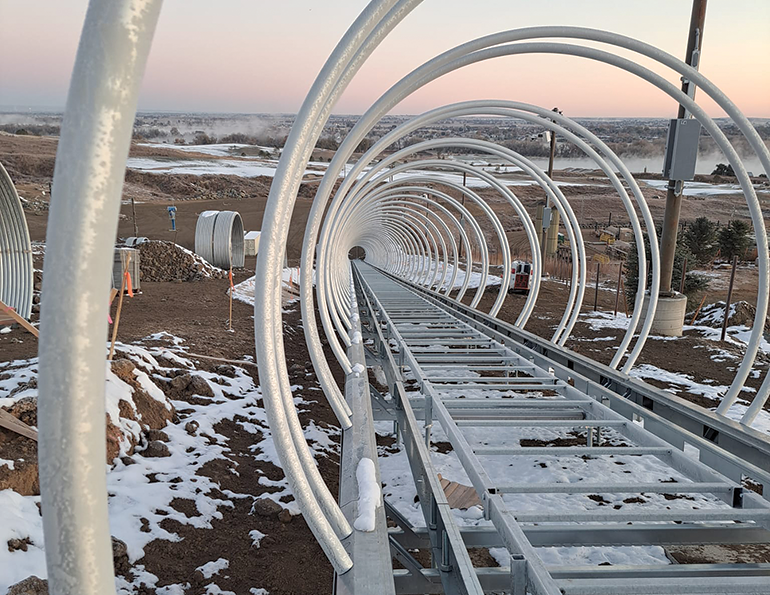

Big orders weren’t limited to aerial lifts. Star Lifts supplied three of what it calls duplex conveyors, where two lifts run side by side. Installations at Big Sky; Summit at Snoqualmie, Wash.; and Bristol Mountain, N.Y., are among the first such lifts in North America.

Star Lifts USA president Conor Rowan says running two conveyors parallel and at higher speed allows more guests to ride. “It’s all about capacity,” he says.

Bells and whistles. Companies like Boyne Resorts that invest in state-of-the-art chairlifts tend to do the same with conveyors. Summit at Snoqualmie’s new double conveyor features adjustable LED lighting throughout. Lift operators can select any color on the RGB spectrum via touchscreen to set the color of the conveyor for night skiing. “Every option SunKid has, Boyne likes to have,” notes Rowan.

Chairlift loading conveyor sales really boomed this season, too, with a record 17 Chairkit conveyor installations in North America. Most of those were installed on new lifts, though a few were retrofits to increase speed and efficiency of existing lifts.

Carl Skylling, president at Skytrac, which installed three quads with loading conveyors this year, says it’s all about getting the true capacity out of a multi-million-dollar investment. “For a 2,400-person-per-hour quad with a six-second interval, to really not be stopping that lift all the time, a loading conveyor really helps.”

MND conveyor at the new Hoedown Hill, Colo.

MND conveyor at the new Hoedown Hill, Colo.

Big Sky, Mont., installed one of three new Sunkid duplex conveyors in the U.S.

Big Sky, Mont., installed one of three new Sunkid duplex conveyors in the U.S.

A new Team Service Carpet/Planet Movers conveyor at Hudson Bay Mountain, B.C.

A new Team Service Carpet/Planet Movers conveyor at Hudson Bay Mountain, B.C.

Dealing With Demand

Overall, the number of lifts installed fell slightly from 2022, which manufacturers say was more a result of supply constraints than lower demand. Leitner-Poma’s Mauch says the company pushed a few projects to 2024 to avoid a repeat of 2022, when supply chain and labor challenges caused some lifts from multiple manufacturers to be load tested later than planned.

“There was a little more demand than we could meet this year,” he notes. “One of the things we learned from last year was to make sure that we had a doable volume we could complete as contracted. After we got caught with supply chain issues last year, we wanted to be cautious not to take too much on.”

Deadlines met. The plan paid off and as of late November every Leitner-Poma lift was on track to open on time or early. Mauch also notes five of Leitner-Poma’s largest projects this year were part of greenfield expansions, including a bubble lift at the brand-new Wasatch Peaks Ranch in Utah. “In some ways expansions are easier,” he says. “There’s no removal, so that’s a nice aspect of it. Keystone, Aspen, and Steamboat were all really well prepared with the access we needed. It’s exciting to be in the Wasatch Peaks project because there are not many new ski areas going in.”

Schmitz says Doppelmayr could have supplied more lifts from its factories than it did this year but was limited by how many it could install for customers turnkey. “We were very careful this year not to over commit our construction resources and had a couple projects we could not commit to for 2023 based on that limitation,” she says.

In-house installation. Certain operators such as Nub’s Nob, Mich., and Holiday Valley, N.Y., opted to install lifts in-house with their own employees and subcontractors. Snowriver, Mich., utilized a hybrid model with a construction supervisor from Doppelmayr working alongside the ski area’s own employees and contractors.

“All of us are searching for solutions to the installation demand and challenges finding crews to install lifts,” notes Skylling. “That means bringing in more subcontractors and working with customers to see what parts or projects they may be capable of completing themselves.”

Supply chain management. Leaders say some Covid supply chain woes linger, particularly with electrical switch gear and diesel engines. “We still have issues with supply chain, but we’ve given ourselves more runway to react,” says Mauch. “When we have issues, they don’t have any impact on completion.”

Lingering longer than Covid supply chain issues is strong demand for lifts, a result of record skier visits last year and the continued need to retire old equipment. Sister companies Leitner-Poma and Skytrac are bullish enough that they broke ground on a new production and parts facility in Tooele, Utah, in October 2023. Set to open in May, the 130,000-square-foot building will increase the firms’ capabilities.

“It’s going to open a lot of capacity and we are going to be able to staff up to meet demand,” says Skylling. “We will increase machining, welding, fabricating, and engineering with room to really grow.”

Mauch says Leitner-Poma already has several large, direct drive lifts on the books for 2024 as of November. “We have a lot of early orders now for ’24, and that’s great because it keeps us in our model of on-time deliveries. Our company is really committed to this market and we are going to do as much fabrication as we possibly can in the United States.”

Doppelmayr cautioned steep inflation and high interest rates are impacting not only customer decision-making but also internal planning. “We are excited about early commitments from some of our clients for 2024 and 2025, but recognize there are some challenges, particularly around some customers’ access to capital,” says Schmitz. “At the same time, record skier numbers and the continued challenge of very old lift infrastructure in the U.S. and Canada continues to fuel the demand for new lifts.”