Summer in the mountains has evolved from “off-season” to “on” as North American mountain resorts have added summer activities to create year-round operations and diversify revenue sources. Many are utilizing existing winter infrastructure to do so: 68% offer scenic chairlift rides and about 52% have lift-served mountain biking, according to a summer operations survey of North American ski area operators conducted by SAM in fall 2024.

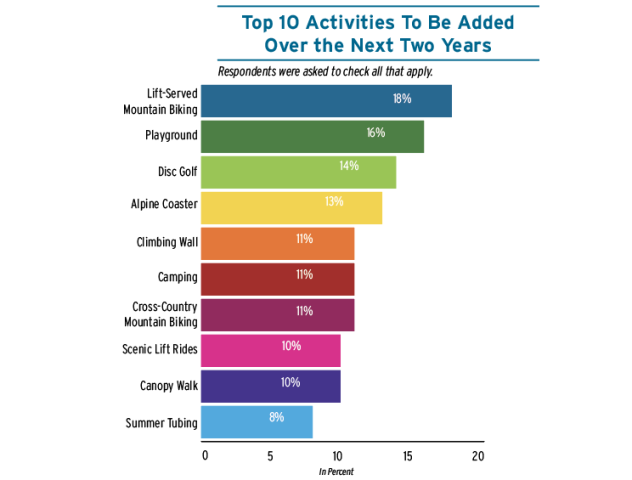

More ski areas plan to use their lifts for summer in the next two years, with 18% of respondents planning to add lift-served mountain biking and 10% adding scenic rides. And summer operations have myriad benefits, too: roughly 92% of respondents agreed or strongly agreed that summer offerings attract new user groups; more than 95% agreed or strongly agreed that summer business improves hiring and staff retention.

Many ski areas are capitalizing on new participation trends and an increased desire to get outdoors. Others have had more challenges in creating a green-season draw.

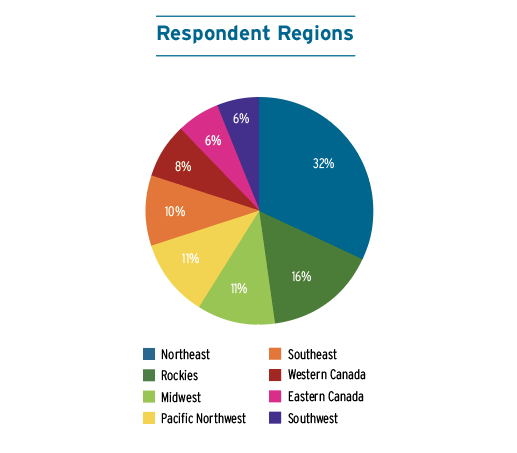

SAM asked the mountain resort community to share data and anecdotal observations about their summer operations experience. Sixty-two resorts in the U.S. and Canada offered their insights into what’s happening in summer and where we’re going next.

Here, we share data, analysis, and individual responses from the results of the online survey, with additional insights from Claire Humber, principal at resort planning firm SE Group. Any ambiguities or errors are our own.

Activities

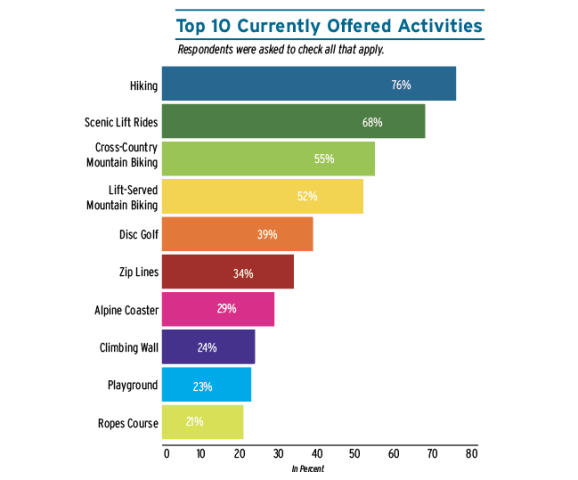

What activities do winter resorts offer in summer? Hiking (76%) and scenic lift rides (68%) were the most common among our sample.

“If only a small percentage of the overall population participate in snowsports, it follows that much of the population has not spent much time on a lift and many may not have been to the top of a mountain,” said Humber. “A ride on a lift to the top of the mountain is often the simplest and most obvious experience a ski area can offer.”

Mountain biking. Cross-country mountain biking and lift-served mountain biking, 55% and 52%, respectively, followed by disc golf (39%) round out the top five offerings. Mountain biking, in both its forms, is another activity that utilizes winter infrastructure, either with lift or trail systems. These can both be capital- and operational expense-intensive activities to launch and operate.

Those that do it well, in the right marketplace, are finding lift-served mountain biking to be a huge boon to their summer business. “Lift-served mountain biking has been growing at 30-40% per year,” shared a Northeast respondent. Others report that it is not the draw they initially thought it could be. “Lift-served mountain biking is, at best, a break-even, particularly when capital costs are considered,” said a Rocky Mountain respondent.

A notable share of mountain resorts have installed adventure activities, such as zip lines (34%), alpine coasters (29%), and ropes courses (21%), as well as climbing walls (24%) and playgrounds (23%) for their younger guests. “The mountain coaster is the biggest driver of paid summer visits,” said a Rocky Mountain ski area.

Activities not included as an option on the survey but written in as “other” include go karts, gem mining, ice skating, a spa, ATV tours, and scenic highways.

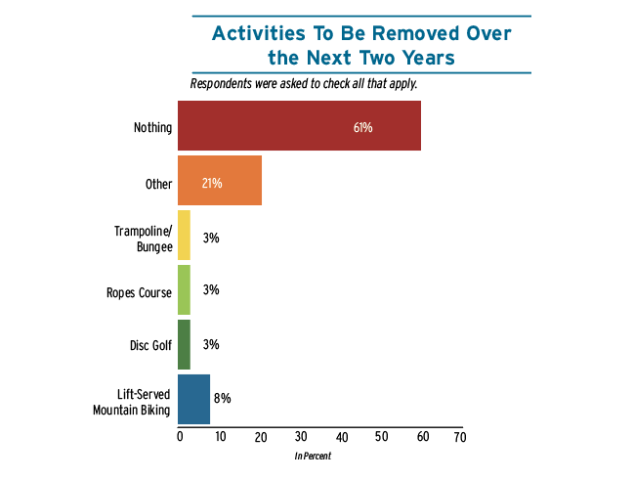

Churning the activity mix. Some ski areas have found that certain offerings don’t work for them. For example, a Northeast operator said, “We retired our aerial ropes course in 2020, as visitation had dropped and expenses to operate had increased. The material cost to replace existing summer tubing—not as much fun as winter tubing—may lead us to retire this attraction.”

More than 38% of ski areas plan to remove an activity or activities from their mix over the next two years. Eight percent of respondents plan to remove lift-served mountain biking in the next two years, while roughly 3% plan to remove disc golf, ropes courses, and/or bungee trampolines. Glamping, summer camp programs, and alpine slides were among other offerings ski areas plan to remove. Otherwise, more than 60% said they were not planning to remove anything.

Conversely, 86% of respondents plan to add activities to their summer operation in the next two years.

Despite the challenges mentioned by some operators, lift-served mountain biking also has huge growth potential: 18% of respondents said they planned to add it or expand their current offering.

Playgrounds were the second most common planned addition (16%), which suggests a desire to reach all age groups. Another 14% plan to add disc golf, and 13% are adding an alpine coaster.

Two of the top four planned additions (disc golf and playgrounds) are typically not pay-to-play activities, or are at least not typically profitable on their own, while the other two (lift-served mountain biking and alpine coasters) require huge capital investment, but have the potential for huge return.

In respect to activities that do not make a profit (e.g., break even or operate at a loss), one Western Canada resort said, “These provide alternate options and create a sense of animation that help with the overall value of the experience.”

Operators are also continuing to identify that this summer market has different goals when it comes to the ease and physicality of their experiences. “We’ve found there is a market for these adventure-lite activities among folks who have hung up their skis but still enjoy being on a lift, parents with young children getting them accustomed to riding a lift before they begin skiing/riding in winter, folks who would never consider skiing, and folks looking for easy-access summer activities,” said one Rocky Mountain respondent.

A key in creating an effective activity mix will be identifying ways to accommodate that desire for low-barrier-to-entry offerings. “One example,” said Humber, “would be to create a hiking experience for all abilities. Not just ‘head uphill until you get to the top,’ but smaller loops that offer a great nature-based experience without a lot of physical exertion.

“The complexion of activities, programs, and events you offer has to respond to market depth and demand,” she continued. “You have to do your homework to identify the needs and wants of your summer audience.”

Programs & Events

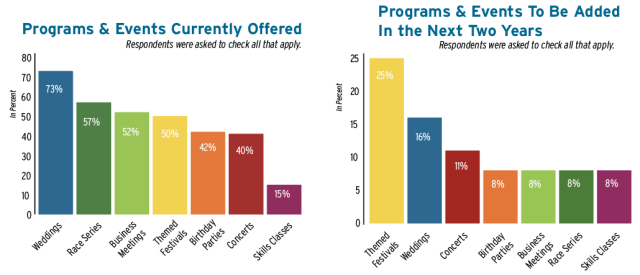

Seventy-three percent of respondents offer weddings, and 57% offer a race series or race event. Fifty-two percent of respondents offer corporate gatherings or business meetings and 50% host themed festivals. Skills classes, such as yoga or pottery, are offered by about 15% of respondents.

Weddings. Events and programming can be beneficial to overall summer operations, but also have the potential to be disruptive. When hosting events on-property, staffing, logistics, and safety are all considerations. Public events are often easier to integrate with your daily activities than private events, said Humber. It is important to ask if existing daily operations will complement or hinder the event, she said, particularly when it comes to hosting private events such as weddings.

“Weddings tend to involve a lot of time and stress but not a lot of money, particularly if the timing causes delays for our other events or for the opening of our rental shop for seasonal rentals,” shared a Northeast operator.

Said a Southwest operator, “Current summer offerings are limited to weddings and business meetings, which operate at a healthy profit margin. However, there is limited capacity for these types of events. There are only so many available weekends for weddings, and we can only do 1-2 per day.”

“If profit potential rules the future, we should do events, festivals, weddings, and run one lift for sightseeing and downhill mountain biking,” said a third Rocky Mountain region respondent.

Event additions. Operators are looking to capture that success with plans to add more events to their summer lineups. Of the 25% of ski areas planning to add themed festivals, only 4% also said they already offer them. This suggests that within the next two years, roughly 71% of total respondents plan to offer these types of events.

Similarly, 16% of respondents plan to add weddings to their roster of summer services, despite the operational challenges. Four percent of the respondents that plan to add weddings also said they already offer them. So, if all of the respondents that plan to add weddings do, more than 85% of respondents will host nuptials within the next two years.

Additionally, operators wrote in as “other” that they plan to add events such as immersive light experiences and drive-in movies. These night events have the potential to drive lodging and food and beverage revenue.

A respondent from a rural Midwest ski area shared that an immersive art experience, which was partially hosted at the ski area, drew people by the thousands to the region in 2024. This operator was able to shift a winter chalet into an ice cream and coffee shop to capture revenue from visitors to the art installation.

Another respondent from a Northeast ski area noted that among their most profitable summer offerings are “Specialty events that bundle scenic lift rides and food & beverage, utilizing our mid-mountain lodge.”

Who is Coming in Summer?

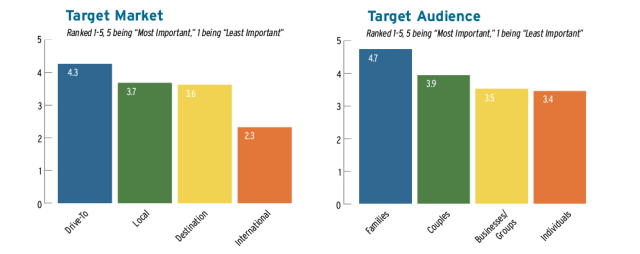

Drive-to visitors are the most important market to respondents of this survey. Several respondents made a distinction between “drive-to” and “drive-by,” the latter meaning passersby that may not have previously planned to stop.

Operators looking to capture drive visitors need to create a unique value proposition that draws guests in from the area. Unlike in winter, when ski areas offer one of the only viable and often the most visible activity in a region, in summer, a ski area is not the only game in town. Reaching your target market may require a different marketing strategy. “You want to get on the ‘top 10 things to do in...’ lists that show up in media and/or come up in web searches, and/or be a place that tour operators put on their itineraries,” Humber advised.

The local market ranked second, which may be indicative of the respondent sample being “community adjacent.” In summer, resorts have an opportunity to capture members of their local audience who may not participate in snowsports but do participate in non-winter activities. Locals also represent a significant opportunity for repeat summer visitation. A weekly bike race series, for example, like the “ski bum” race leagues of winter, or a weekly concert series can become part of locals’ weekly routine during the summer season, drawing them to your resort again and again.

Destination visitors, meaning overnight guests, ranked third, very closely behind local visitors. When targeting destination visitors, it’s important to examine the regional market to determine the right mix of offerings. Does your ski area need the lodging, F&B, activities, and programming mix to fill entire days, or are you a piece of a larger regional puzzle driving visitation to the area?

“Understand the guest is looking for instant gratification. They are no longer interested in spending all day at the resort; too many other Instagram moments for them to fit in during their visit,” said one Rocky Mountain resort

“Destination markets are often ‘activity rich,’” said Humber, “which can be an opportunity and a challenge: an opportunity to become part of the richer experience (i.e., your offerings add to other regional attractions to create a compelling reason to visit), and a challenge, as you have a lot of competition.”

Target audience. Unsurprisingly, families overwhelmingly ranked as the top target audience for summer business. Couples and businesses/groups followed in second and third, respectively. Several respondents optimistically wrote in “anyone” as their target audience.

In respect to “anyone,” yes, the summer audience is far bigger and more diverse than the winter audience, but that makes it even more important to choose your targets wisely and not waste resources on installing the wrong activities and programming, or marketing to people who aren’t interested in what you offer.

For example, one Western Canada ski area said its distance from a major metropolitan area hindered the success of its ropes course, leading to the realization that “it was not the right offering for a limited summer business model.”

Measures of Success

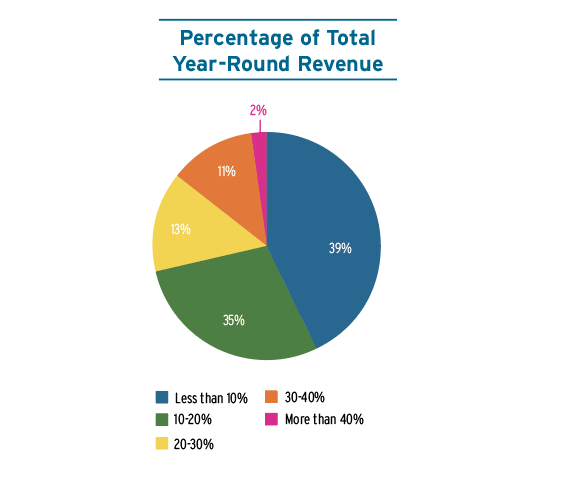

On average, summer business accounts for a fraction of year-round revenue. Thirty-nine percent of respondents said that summer operations made up less than 10% of year-round revenue, while about 35% said it made up between 10-20% of year-round revenue. According to NSAA’s 2022-2023 Economic Analysis of U.S. Ski Areas (the most recent available at press time), summer revenue made up an average of 11.9% of total revenue for those that offered it. This is a small decrease from 2021-22, which reported 12.3% of total revenue.

SAM’s survey asked respondents to choose a range of percentage of total revenue rather than a specific number, in part to make it easier for respondents to answer. While the Economic Analysis number appears to track lower than that of our survey results, they both tell a similar story about summer’s contribution to overall revenue.

Profitability. While not a major contributor on average to the overall bottom line at most ski areas, summer operations are profitable, for the most part. “Each of our summer offerings turn a profit under normal circumstances. We have seen great growth in our summer businesses this past summer,” said a respondent from a Northeast ski area.

Fifty-eight percent of respondents said that less than 10% of their summer offerings operate at a loss and 53% stated that more than 40% of their summer offerings were profitable.

However, the profitability calculation has many variables, according to respondents. One from a Southwest ski area said, “Summer operations do make a profit, if only factoring in the labor costs associated with the summer activities. If we include year-round staff and annual maintenance, insurance, and property taxes, we’d lose money every summer.”

A Rocky Mountain respondent said, “Summer as a standalone is not profitable. It does provide an offset to the losses that a resort experiences during non-winter operations.”

Often, operators look at break-even or loss activities as supporting other revenue sources, which may not be calculated into summer profitability. “The break-even activities build broader support for other summer and winter programs,” said one Northeast mountain.

“We organize theme days and special events for our guests. We use them as a value-added service, keeping families coming back year after year,” said a Southeastern resort.

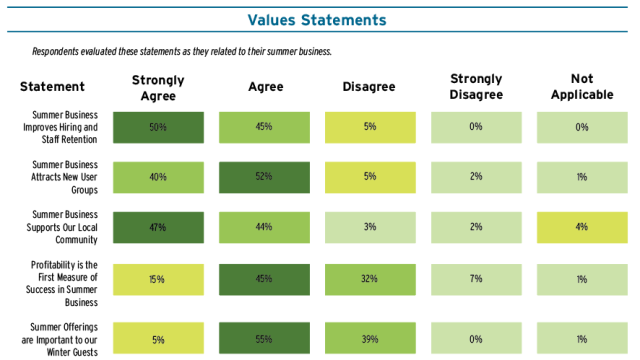

While profit is a standard KPI (key performance indicator), when asked to evaluate several statements in relation to their summer business, only 60% of respondents agreed or strongly agreed that “profitability is the first measure of success in summer business.” The remaining 39% disagreed or strongly disagreed with that statement.

Alternative metrics. Responses to the value statements offer clues into alternative metrics resorts may be using to calculate the ROI on summer operations. For example, the impact of summer business on hiring and staff retention achieved the greatest consensus among respondents, with 95% agreeing or strongly agreeing that summer business improves hiring and staff retention.

Given how labor-intensive the mountain resort industry is, an improved ability to hire and retain staff has obvious impacts for winter operations, such as reduced onboarding and training hours and fewer departmental staffing gaps. That this was the most agreed upon statement regarding summer business speaks to the 365-day nature of modern mountain resort operations, but also to the fact that summer operations are still largely considered in relation to how they can support or offset winter business.

As one respondent from a Northeast resort noted, “The operating window for summer operations is profitable, however, when you layer in the shoulder seasons, summer becomes a break even. It supports the needed year-round cash flow and creates summer and year-round employment opportunities.”

Just behind hiring and retention, 92% of respondents agreed or strongly agreed that summer business attracts new user groups (while only 60% agreed or strongly agreed that summer offerings are important to winter guests).

More than 90 percent of respondents agreed or strongly agreed that summer business supports the local community. Those community benefits can be realized in a variety of ways: employment opportunities; activities or programming geared toward locals; an activity mix that complements offerings in the broader community, etc.

While alternative success metrics are important performance indicators, financial goals are necessary for the growth of summer business. “Setting and monitoring financial goals is just sound business,” said Humber, “even if profitability metrics reflect other considerations.”

As operators review their summer activity mix, they must weigh the cost/profit of an individual activity against its value in the bigger picture. For example, does the cost of operating this activity exceed the benefit of the food and beverage purchases it supports? Does the space this summer offering takes up limit the potential for other growth?

Growth goals. Looking ahead, respondents said they aim to grow summer revenue. “Our plan is to bring summer operations revenues to about half that of winter revenue in the next 10 years. This will require substantial growth in our summer product offering,” said one Northeast respondent.

“We will double summer business as a way of diversification,” said a respondent from a Midwest ski area.

Climate change impacts

With shorter winters and increasingly higher temperatures in summer, operators should think long-term and potentially prioritize year-round business. The opportunity is there to become an established summertime attraction.

“[Summer business] will become more and more important for areas that operate in more volatile climates,” observed a Northeast operator.

“Summer-focused activities will blend further into the shoulder seasons, potentially even add onto the winter experience, [and] ultimately continue the trend of a 12-month focus,” said another in Western Canada.

“Summer-centricity is very important to us and has been for over 30 years. Climate change and cyclical winter snowfall highlights the need to diversify operations into more year-round/summer activities,” said a third operator in the Pacific Northwest.

Historically, mountains were a summer escape. City dwellers left the oppressive heat to enjoy cooler temperatures up in the mountains. This trend dwindled slightly with the advent of air conditioning. However, the post-Covid desire to be outside has the potential to push people toward cooler recreation locations such as lakes, the beach, and of course, the mountains. “As summers get hotter, we should see more people wanting to recreate at elevation, where we are typically 15 degrees cooler than the valley,” said one Rocky Mountain region respondent.

Where Do We Go Now?

There is a huge opportunity to capitalize on the non-winter months, but there is also more competition in the marketplace in summer. A “build it and they will come” mentality no longer works.

“Our region draws five times the [summer] visitation as winter, yet we do about 20% of our business in the summer. With additional attractions, there is more opportunity to balance our seasons,” said a Northeast operator.

To take adavantage of the opportunity, ski area operators must be at least as thoughtful and strategic in their approach to summer operations as they are to winter operations to build and create memorable, profitable, and on-brand experiences that are specific to their unique location, community and culture