National Ski Areas Association (NSAA) data show that winter resort visitors have been less satisfied with their experiences than at any other time in the last decade. The declines are significant and appear to be real. Fortunately, they do not apply to all resorts across the country—just the largest and most popular ones. However, that finding is likely a result not only of guest experience but also data collection and processing.

The results from NSAA’s 2022-23 “Kottke End-of-Season & Demographic Report” provide warnings about how pricing, crowding, and increased guest expectations, among other factors, appear to be hurting guest satisfaction and loyalty.

After eight years of relatively stable ratings ranging from 70 to 74 and averaging 72, “Likelihood to Recommend” Net Promoter Scores (NPS) declined 8-9 points the last two seasons, compared to the first Covid season of 2020-21, according to the 2022-23 report. This suggests a dramatic decline in ski area guest satisfaction and loyalty, and the question is whether the declines are transitory or the beginning of a new normal.

In addition to presenting the “Likelihood to Recommend” NPS trends, the “Satisfaction” section of the “Kottke End-of-Season & Demographic Report” also includes the 10-year rating trends for the “Likelihood to Return” and seven satisfaction attributes: Grooming, Skiing/Snowboarding Experience, Employee Service, Price/Value, Food and Beverage, Lessons, and Rentals.

The national “Likelihood to Recommend” NPS declined sharply in 2021-22 and did not recover in 2022-23, which could mark the start of a new normal in lower guest loyalty and satsifaction ratings. Source: NSAA’s 2022-23 “Kottke End-of-Season & Demographic Report”

The national “Likelihood to Recommend” NPS declined sharply in 2021-22 and did not recover in 2022-23, which could mark the start of a new normal in lower guest loyalty and satsifaction ratings. Source: NSAA’s 2022-23 “Kottke End-of-Season & Demographic Report”

Mirroring the NPS trend, all seven satisfaction rating trends were positive through the 2020-21 season except “Employee Service,” which began its decline that season. The lower satisfaction ratings during 2021-22 and 2022-23 mirror the trend in Net Promoter Scores.

WHERE DID THE NPS DECLINES OCCUR?

The tables accompanying the Kottke End-of-Season & Demographic Report indicate that the national declines in NPS the last two seasons occurred in the “large” and “extra-large” ski areas categories and in the Rocky Mountain and Pacific regions. The large and extra-large ski areas, which accounted for 74 percent of U.S. skier visits in 2022-23, accounted for nearly two-thirds of the total respondents for the report.

While not addressed in the report, the accompanying tables (which are sent separately with the report) do indicate that large ski areas’ NPS declined from 67 in 2019-20 to 58 in 2022-23—the largest decline of the ski area sizes.

The NPS for the Rocky Mountain region—which accounted for 43 percent of skier visits and 49 percent of the total respondents to the demographic survey—declined a whopping 12 points, from 79 in 2019-20 to 67 in 2022-23, the largest dip of any region. Large ski areas and the Rocky Mountain region accounted for most of the national NPS declines.

POSSIBLE REASONS FOR RATING DECLINES

What’s behind the decline? To find out, we sought input from industry leaders, pored over the 2022-23 “Kottke End-of-Season & Demographic Report,” reviewed supplemental information provided by RRC Associates, and mined Guest Research’s partner data. Through all this, we have identified the following as probable causes of the industry declines in satisfaction and loyalty the last two seasons. These causes and explanations fall into two general areas: guest experience, and data collection and processing.

Guest Experience

Record skier visits and overcrowding: The record skier visits the last two seasons—aided by record snowfall in the Rocky Mountain and Pacific Southwest regions—led to increased crowding on weekends and holidays, despite the fact that 64 percent of ski areas “limited the number or set maximum capacities on the number of lift tickets sold,” according to NSAA. This overcrowding lengthened lift lines and restaurant lines, increased slope congestion, and made parking more difficult. These conditions increased guest frustrations, decreased the fun guests enjoyed, and left skiers feeling less valued by the ski area.

Reduced services and labor shortages: Covid-forced reduction in services, combined with labor shortages, impacted most ski areas during 2020-21 and 2021-22, degrading the guest experience. The industry’s 2020-21 NPS, however, did not reflect this as it increased three points year-over-year to 74, perhaps due to guests’ excitement to leave their homes for the great outdoors and skiing amid Covid restrictions and lockdowns.

It is also possible that it was caused by the small sample size of only 36 participating ski areas that year. Staffing did improve during the 2022-23 season when the industry adjusted wages and welcomed more J-1 visa students, which NSAA’s “Employee Service” ratings and Guest Research’s “Friendliness/Helpful” ratings do support, meaning that satisfaction scores rose for this attribute.

Ticket window price resistance: According to the 2022-23 Kottke Report, average adult weekend ticket window prices increased by 38 percent from 2019-20, while the average total ticket yield increased by 22 percent—all of it during the last two seasons. NSAA-reported “Price/Value” ratings declined sharply from 2020-21, primarily among the extra-large ski areas and in the Rockies.

Numerous Guest Research clients suffered significant declines in “Value for Price Paid” ratings during the past four years. For those ski areas, the importance of this attribute increased to become one of the top four or five drivers of (i.e., most highly correlated with) “Likelihood to Recommend” NPS.

Not all operators and marketers we reached out to felt the increases in pricing were a primary cause of the NPS declines. While some non-pass guests may be aware of how to secure a discounted ticket, others, especially first-timers, may not be, thereby discouraging trial. Few operators were aware of the overall declines in “Value for Price” ratings in the report.

Higher expectations: While not directly measured, expectations likely rose in the aftermath of the pandemic and as a result of industry consolidation, higher prices, and the significant capital investment ski areas have made to enhance the guest experience. Since satisfaction is based on expectations, increased expectations were likely another contributing cause for the NPS declines.

Reduced emotional engagement of guests: Purchase decisions and brand selections are based on emotion and justified with logic. The bigger crowds, reduction in services, labor shortages, and price increases likely negatively affected how guests felt they were being treated by the ski areas, thereby reducing their emotional engagement.

Emotional engagement is a necessary requirement for loyalty, responsible for turning Passives into Promoters. This is confirmed by Guest Research’s emotional connections ratings, which increased during the 2020-21 season before declining significantly the last two seasons. Emotional engagement is highly correlated with satisfaction and loyalty. (See “How Does That Make You Feel?” SAM March 2024.)

Data Collection & Processing

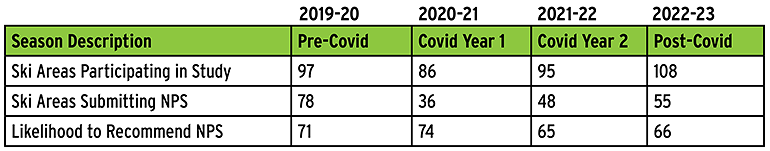

Small and reduced sample sizes for ski areas contributing NPS ratings: While 108 ski areas provided data for the 2022-23 National Demographic Study, only about half of those (55) provided their Net Promoter Score. That’s down from 78 (80 percent of respondents) in 2019-20, but up from 36 in 2020-21, which is the same year the NPS increased to a peak of 74 before its sharp two-year decline. The smaller sample sizes may also be a contributing cause of the lower scores.

Small and reduced sample sizes of ski areas providing NPS ratings may also be a contributing cause of the lower NPS. Source: RRC Associates / NSAA.

Small and reduced sample sizes of ski areas providing NPS ratings may also be a contributing cause of the lower NPS. Source: RRC Associates / NSAA.

It’s difficult to pinpoint why so few ski areas contribute their NPS to the study. The responses are aggregated and individually anonymous, after all. Greater participation would provide a more holistic view of guest satisfaction with the ski area experience.

Other possibilities: Other possible explanations for the NPS declines include year-to-year changes in which ski areas submitted their NPS data and changes in survey methodology and processing. We were not able to evaluate these, however, due to not being able to access NSAA’s data.

CONCLUSIONS

The primary causes of the industry’s rating declines vary by ski area, depending on the size and location of the ski area, as well as participation in pass programs, control of crowding, dynamic pricing strategies, and labor supply. For example, the large and extra-large ski areas and those in the Rocky Mountains region appear to have suffered the most from overcrowding. Smaller ski areas reported fewer overcrowding issues.

A trend? Those industry leaders we contacted who had an opinion on how long the declines in satisfaction and loyalty would last were optimistic, believing the declines to be transitory. However, based on the breadth of the satisfaction declines, the steep declines in NPS, the continuing increases in ticket window prices and the high cost of new lifts, we are less optimistic.

In addition, our clients’ ratings—which typically mirror the industry’s annu-al ratings—were unchanged through early March 2024, compared to the same time a year ago. A return to an NPS in the low 70s will likely require several years.

Skiers’ expectations will remain high in the near term but should be normalized as skiers become more accustomed to the prevailing conditions and if overcrowding is reduced. Nonetheless, pricing will continue to be an issue as costs continue to rise and ski areas increase their pricing, putting stress on non-passholders’ price/value ratings and discouraging trial (see “Letter to the Editors,” p. 16). Ski areas need to prioritize emotionally engaging their guests, demonstrating how much they do value them.

RECOMMENDED CHANGES TO THE SURVEY AND REPORT

Awareness of the industry’s NPS rating declines is low; ski areas are focused on their own satisfaction and loyalty scores. Perhaps operators would pay more attention to, and find more value in, the “Satisfaction Ratings” section of the Kottke End-of-Season & Demographic Report if it were more robust and included recommendations and explanations of what it all means. The report has become more refined in recent years, but there’s still room to improve.

NSAA made two important and very positive changes to the survey and study prior to this season, namely: (1) adding an “Overall satisfaction with visit” question (referred to as “CSAT”) to the survey, and (2) changing the name of the survey (now the National Guest Experience & Demographic Study) to incorporate “Guest Experience.”

To further enhance the value of the study to the association’s members, the report should expand on the importance of determining the key drivers of loyalty (NPS) and satisfaction (CSAT). The addition of one or more emotional engagement questions to the 2024-25 survey and an explanation of the importance of emotionally engaging with guests would support this. Emotional engagement is more highly correlated with loyalty and satisfaction than most satisfaction attributes (the primary exception being overall skiing/snowboarding experience).

Explanations of key metrics, such as Net Promoter Score and “Overall Satisfaction with Visit” (and how these two metrics are important but different), as well as reasons for any significant trends in the satisfaction and loyalty ratings would also be beneficial. The Net Promoter and “Overall Satisfaction with Visit” ratings and trends should be highlighted in the Executive Summary of the report as well.

Lastly, we suggest NSAA continue its all-out effort to encourage additional ski areas and multi-property ownership groups to submit their survey data for inclusion in the report. An expanded sample size will make the ratings, rating trends, and cross-tabulated data (by region and size) more reliable.

Net Promoter® and NPS® are registered trademarks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld. Net Promoter ScoreSM is a service mark of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld.